virginia estimated tax payments due dates 2020

If the due date falls on Saturday Sunday or legal holiday you may file your voucher on. Click IAT Notice to review the details.

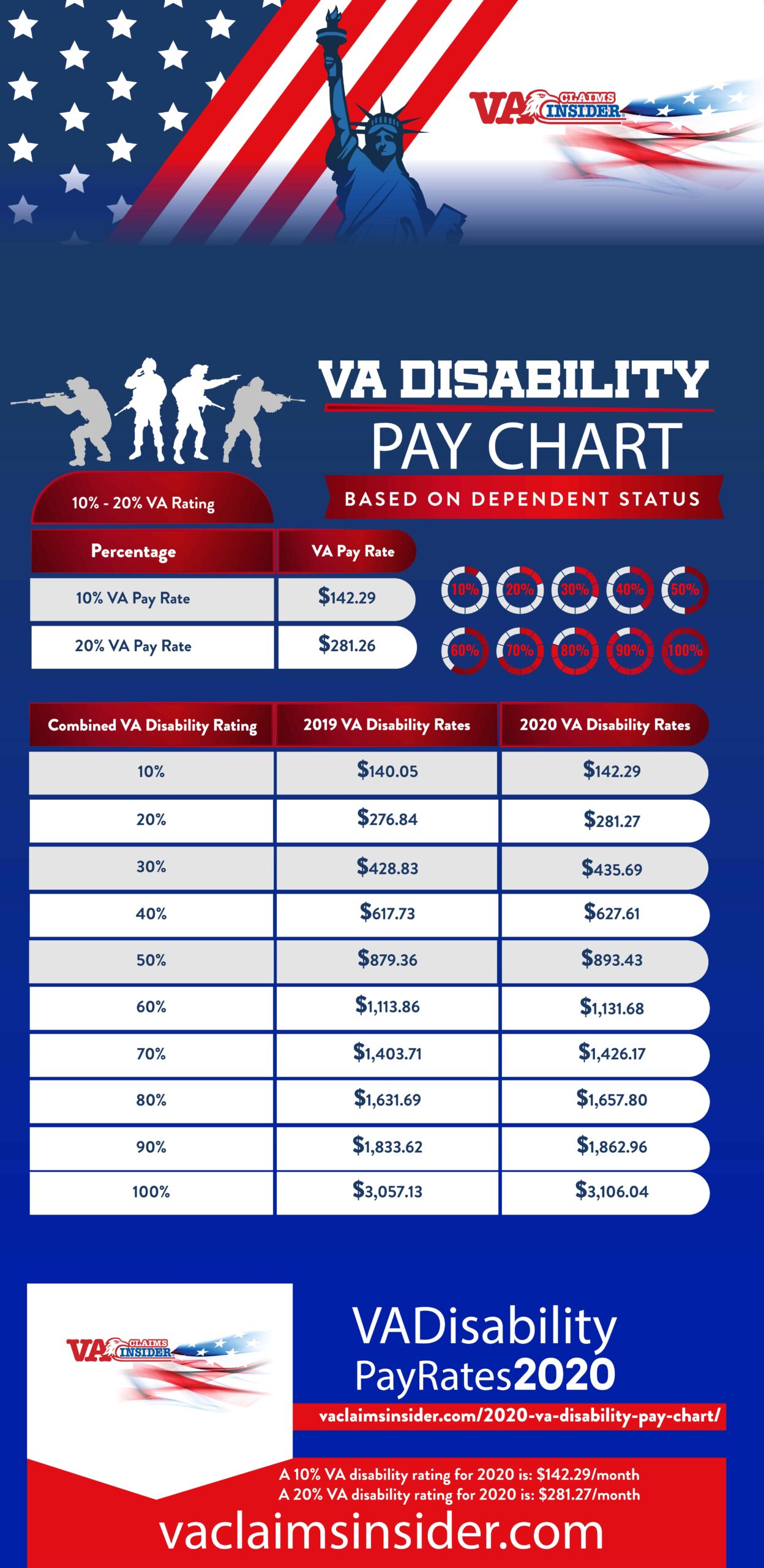

Va Disability Payment Schedule For 2021 Cck Law

West Virginia Code 16A-9-1d Sales and Use Tax.

. Please refer to Publication 505 Tax Withholding and Estimated Tax PDF for additional information. If you file your 2020 income tax return and pay the balance of tax due in full by March 1 2021 you are not required to make the estimated tax payment that would normally be due on January 15 2021. If you file Virginia estimated payments keep an eye on May 1.

Pay bills or set up a payment plan for all individual and business taxes. West Virginia Code 16A-9-1 d Sales and Use Tax. April 15 2020 2nd payment.

All income tax payments due between April 1 2020 and June 1 2020 including estimated tax payments due. If you file your state income tax return and pay the balance of tax due in full by March 1 you are not required to make the estimated tax payment that would normally be due on Jan. Virginia Governor Ralph Northam announced that while filing deadlines remain the same the due date for payment of individual and corporate income tax will now be June 1 2020.

Likewise pursuant to Notice 2020-23 the due date for your second estimated tax payment was automatically postponed from June 15 2020 to July 15 2020. File 3rd Quarter Virginia Estimated Tax. Any estimated income tax payments that are required to be paid to the Department during the April 1 2020 to June 1 2020 period.

Monthly and First Quarter. Virginia net income expected in 2020. I r g i n i a S tat e Ta x D e pa r t m e n t Page 3 INSTRUCTIONS FOR.

Estimated Tax Worksheet This is your record retain for your files 1. The due date for certain Virginia income tax payments has been moved to the deadline of June 1 2020. You can pay all of your estimated tax by April 15 2020 or in four equal amounts by the dates shown below.

Make tax due estimated tax and extension payments. Please note a 35 fee may be. Pay Personal Property and Real Estate Taxes First Half Submit Payment for Vehicle Registration Fee.

Pay all business taxes including sales and use employer withholding corporate income and other miscellaneous taxes. Virginia estimated tax payments due dates 2020. WEST VIRGINIA STATE TAX DEPARTMENT Tax Account Administration Div PO.

West Virginia State Tax Department Tax Account Administration Division Est PO Box 342 Charleston WV 25322-0342 It is also possible to make estimated payments online through Mytaxes at mytaxeswvtaxgov. Please enter your payment details below. File 2nd Quarter Virginia Estimated Tax.

Federal 2020 individual returns are now due May 17. Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2021. Estimated tax payments should be mailed by the due date to.

Under normal circumstances quarterly estimated tax payments for tax year 2020 would have come due april 15 june 15 and september 15 of this year with the final payment due on january 15 2021. CST-200CU Sales and Use Tax Return Instructions Import Spreadsheet. Complete the Estimated Tax Worksheet below to compute your estimated tax for 2020.

See the Estimated Income Tax Worksheet on page 3 of Form 760ES. Individual income taxes Corporate income taxes Fiduciary income taxes and. Pay Personal Property and Real Estate.

Individual returns and 2021 first quarter estimated payments are still due April 15. However the Virginia extension to pay while penalty-free is not interest-free. Due dates for 2019 Virginia Estimated Tax are.

Box 11751 Charleston WV. The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter. 1546001745 At present Virginia TAX does not support International ACH Transactions IATClick IAT Notice to review the details.

At present Virginia TAX does not support International ACH Transactions IAT. File Virginia State Income Tax Return. Please note a 35 fee may be assessed if your payment is declined by your financial institution as authorized by Code of Virginia.

Estimated tax payments should be mailed by the due date to. Nonresident Withholding Tax Payment. March 20 2020 IMPORTANT INFORMATION REGARDING VIRGINIAS INCOME TAX PAYMENT DEADLINES INCOME TAX PAYMENT EXTENSION AND PENALTY WAIVER IN RESPONSE TO THE COVID-19 CRISIS On March 19 2020 Governor Ralph Northam requested that the Department of Taxation extend the due date for certain Virginia income tax payments to.

54 rows under normal circumstances quarterly estimated tax payments for tax. CHECK ONLY ONE PARTNERSHIP FILING FORM WVPTE-100 S CORPORATION FILING FORM WVPTE-100 Taxable Year End. If you file your return after March 1 without making the January payment or if you have not paid the proper amount of estimated tax on any earlier due date.

The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter. If you file your return after March 1 without making the January payment or if you have not paid the proper amount of estimated tax on any earlier due date you may be liable for an additional charge for. Make joint estimated tax payments.

File 1st Quarter Virginia Estimated Tax. June 15 2020 3rd payment. WEST VIRGINIA ESTIMATED Account ID.

2021 first quarter estimated payments are still due May 1. 54 rows Under normal circumstances quarterly estimated tax payments for tax year 2020 would have. The District of Columbia has not moved its individual filing deadline.

VIRGINIA ESTIMATED INCOME TAX PAYMENT VOUCHERS 2022 FOR INDIVIDUALS FORM 760ES Form 760ES Vouchers and Instructions wwwtaxvirginiagov Effective for payments made on and after July 1 2021 individuals must submit all income tax payments electronically if any payment exceeds 2500 or the sum of all payments is expected to exceed 10000. These individuals can take credit only for the estimated tax payments that he or she made. West Virginia State Tax Department Tax Account Administration Division Est PO Box 342 Charleston WV 25322-0342 It is also possible to make estimated payments online through Mytaxes at mytaxeswvtaxgov.

Estimated income tax payments must be made in full on or before May 1 2021 or in equal installments on or before May 1 2021 June 15. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number.

1099 G 1099 Ints Now Available Virginia Tax

Pass Through Entity Tax 101 Baker Tilly

2020 Va Disability Pay Chart Va Claims Insider

Va Disability Pay Schedule 2022 Update Hill Ponton P A

Virginia Dpb Frequently Asked Questions

Va Loan Funding Fee Closing Cost Calculator

2021 Va Disability Rates And Compensation Hill Ponton P A

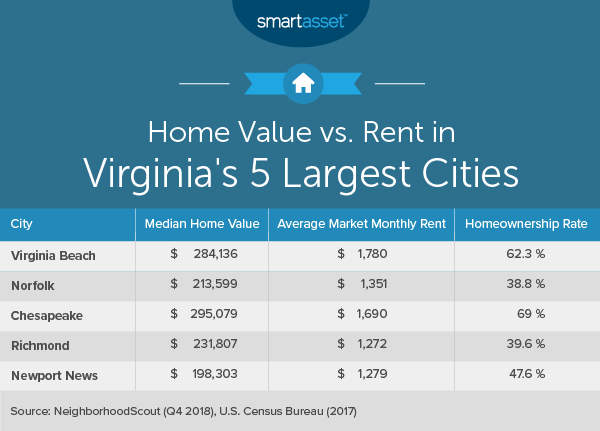

What Is The Cost Of Living In Virginia Smartasset

Va Disability Pay Schedule 2022 Update Hill Ponton P A

Where S My Refund Virginia H R Block

Virginia S Individual Income Tax Filing Extension Deadline For 2020 Taxes Is Nov 17 2021 Virginia Tax

Prepare And E File Your 2021 2022 West Virginia Tax Return

Prepare And Efile Your 2021 2022 Virginia Income Tax Return

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

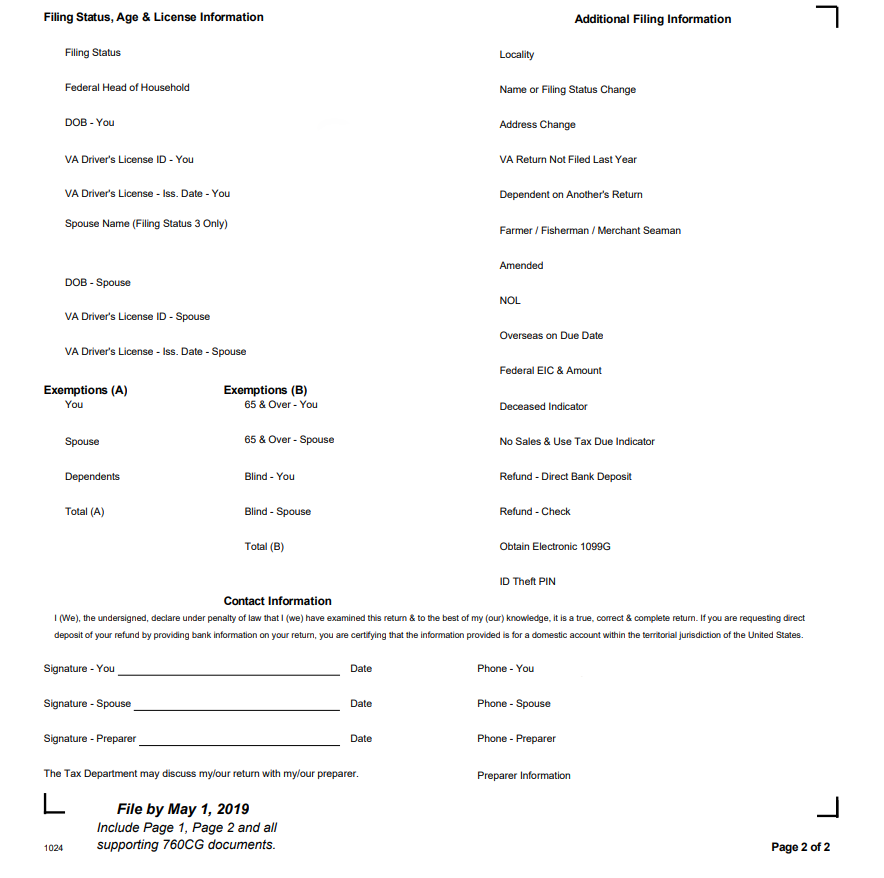

Virginia Tax Forms 2021 Printable State Va 760 Form And Va 760 Instructions

Pay Online Chesterfield County Va

Instructions On How To Prepare Your Virginia Tax Return Amendment